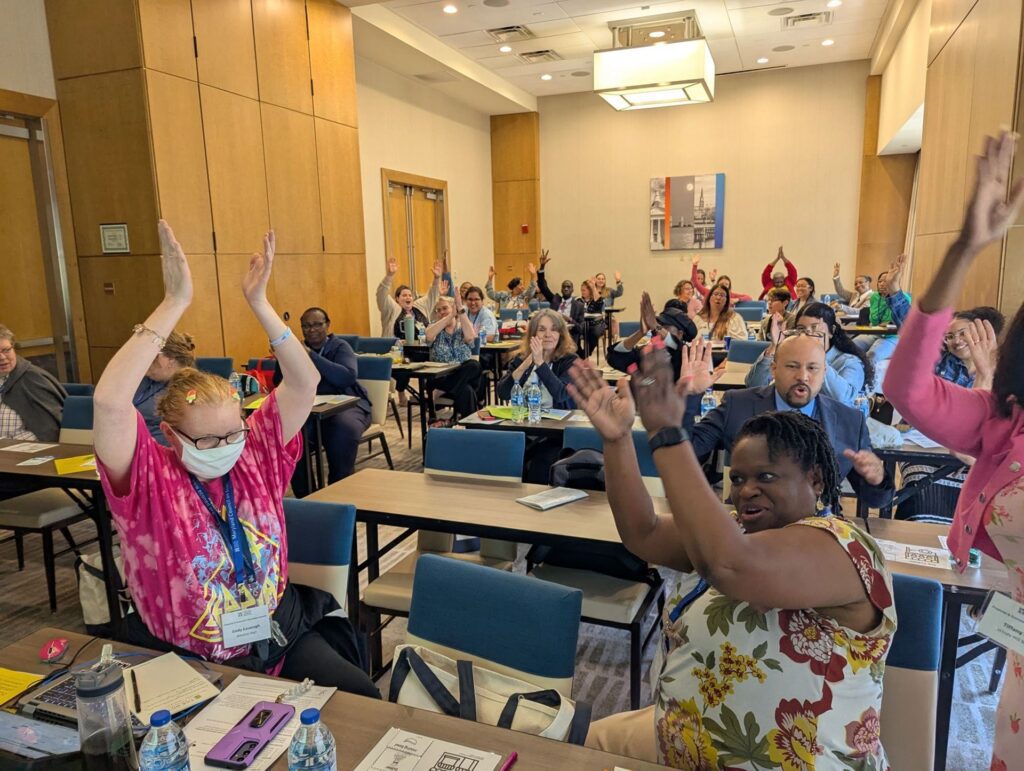

In informative presentations and workshops—as well as during breaks and at lunch, and in the hallways between meeting rooms—150 Maryland educators shared best practices for teaching personal finance and economics and gained insight during MCEE’s Annual Educator Summit in June. The day-long event at The Hotel at Arundel Preserve in Hanover, MD, sponsored by SECU and others, featured 16 sessions and plenty of opportunities for teachers, school administrators, and district leaders to collaborate in order to enhance their classroom instruction and guide engaging student activities.

Sessions at the Summit ranged from those geared towards elementary students, such as How to Help Students Start Saving and How to Use Bluey to Teach Economics, to topics for older students, including understanding problems associated with gambling and identifying scams and frauds. Other sessions introduced children’s literature connected to economics and personal finance concepts, tips for teaching students about saving and managing credit, and empowering women in economics. One session provided insight into coordinating MCEE’s Stock Market Game™ for student competitions, and students provided their perspective on financial education in another session.

Through MCEE’s partnership with the Maryland Council for the Social Studies, additional sessions focused on the economic history of the transatlantic slave trade and the economics of housing practices like redlining and blockbusting.

Presentations at the Summit were led by MCEE staff, classroom teachers, students, and finance professionals from MCEE partners, including the United States Secret Service, First Financial Federal Credit Union, Federal Reserve Bank of Richmond, the Credit Union Foundation of MD/DC, APGFCU, the Maryland Center for Problem Gambling, and the Virginia Council on Economic Education. Educators who facilitated sessions were from school districts in Howard, Wicomico, Calvert, and Frederick counties.

This year’s Summit was oversubscribed with more registrants than any Summit in recent memory. And the response from educators was overwhelmingly enthusiastic. Some of them said:

– Very engaging and wonderful resources. Very helpful—great ideas to encourage student saving.”

– “I took away great ideas from the instructor and other teachers on how to incorporate economics in my classroom.”

– “Super interesting, informational, and full of exemplary teaching methods.”

– “I really appreciate having materials that are engaging and hands-on when teaching concepts in economics.”

– “I enjoyed learning about the new resources, and I feel like they can immediately be implemented in my classroom.”

– “Excellent resources and explanation… real lessons were shared and demonstrated on how to apply learning.”

– “Fellow teachers shared great ideas for incorporating principles into class.”

“We’ve purposely created a community of educators who share experiences and help each other,” noted MCEE Executive Director Julie Weaver. “The ideas they hear and the connections they make with other educators at the Summit impact their teaching practices all year as they integrate personal finance and economics into their curriculum and student activities.”